We pay a lot of taxes, and people should know where it’s going and what they are paying for. This post will focus on local taxes, specifically those going to Yuba County, and special assessments paid by residents in the Arboga, Plumas Lake, and Wheatland areas.

Base Property Tax

Summary: Yuba County gets ~20% of the 1% base property tax as discretionary revenue. In FY 23/24 that’s anticipated to be about $31.5 million, and the Board of Supervisors allocated over 73% to public protection, with 68% of property tax revenue going to the three public safety departments; sheriff (50%), probation (13%), and district attorney (5%).

Details: Every homeowner in California pays a 1% annual property tax based on the value of their property (as limited by Prop 13). Out of that 1% collected, the County receives about 20% as discretionary revenue. If your house is valued at $500,000, you will pay $5000 in annual 1% property tax, and the County would receive $1000 of that as discretionary revenue. In the FY 23/24 budget, over 73% of the 1% property tax received by the County was allocated to public protection departments, with 68% going to the three public safety departments [Sheriff (50%), Probation (13%), and District Attorney (5%)]. For a $500k home, that would be $730 out of $1000 going to public protection, including ~$500 to the sheriff’s department. For a detailed description of how discretionary revenue is spent, you can view the FY23/24 budget. Pay close attention to the revenue line in each department’s budget summary labeled “Net County Cost.” These are the discretionary funds (i.e., property and sales tax) that go to that department. Every parcel is slightly different, but to see where the other 80% of your property taxes go, click here to view a pie chart produced by the Yuba County tax collector.

Special Assessment Types

In addition to the 1% base property tax on your tax bill, almost all residents have additional assessments on their bill. The sections below describe the different types of assessments you might find on your bill.

General Special Assessments

General special assessments fund services received by residents beyond what the base 1% property tax can fund. They can be added or modified by voters or instituted before development by a vote of the property owners doing the development. Some general special assessments are fixed and others increase annually to keep up with inflation. Some examples of special assessments that fund ongoing services to residents in Plumas Lake include the CSA66 and RD784 assessments and in Wheatland the RD2103 and Wheatland Fire Authority assessments.

Mello Roos Assessments

Sometimes a bonds are sold to fund infrastructure for new development. A mello roos assessment is placed on the new homes to pay back the principal and interest on the bonds (like a mortgage). Once the debt is paid (usually 20 to 30 years), the mello roos assessment is removed from the property tax bill. Some mello roos assessments have a fixed annual rate and some increase based on an annual inflator. Many mello roos assessments start with CFD. Examples of mello roos assessments in Plumas Lake are the PLESD CFD, the OPUD 2002-1 CFD, and the TRLIA CFD. Examples in Wheatland include the SCIP 21-03 Caliterra Ranch assessment.

School Bonds

To fund significant facility projects, including new schools, districts often go to the voters and ask them to approve school bonds. Think of a school bond as a loan that the school district takes out to build or enhance facilities. Like a mortgage, the taxpayers pay the principal and interest on this loan over a 20 to 30-year period. Once the loan is paid off, the item is removed from the tax bill. School bond assessments are usually associated with the assessed value of a property.

Plumas Lake/Arboga Special Assessments

Summary: Most homeowners in Yuba County have some kind of special assessment on their property tax bill in addition to the standard 1% property tax. They go to a variety of local agencies for various purposes. These are restricted funds and must go to the designated agency and be spent on the specific purpose identified. In Plumas Lake, total special assessments range from about $1400 to about $5000 depending on the parcel, with about $180-$500 going to the County for various specific services. The remaining money goes to other local school and special districts, including Linda Fire, TRLIA, RD784, OPUD, PLESD & WUHSD (or MJUSD), and Yuba Community College District.

Details:

CSA 66 Assessment

This assessment is designated for services and maintenance in the Plumas Lake area. It may vary based on the zone of benefit (A/C/E) and ranges from ~$525 annually to ~$695 annually. You can read more about CSAs here. A rough breakdown of the assessment is:

- ~$75 to $85 goes to Yuba County to maintain roads (depending on the zone of benefit) within Plumas Lake

- ~$30 to $90 goes to Yuba County to operate street lights (depending on the zone of benefit) in Plumas Lake

- ~$60 to $140 goes to Yuba County for landscape maintenance (depending on the zone of benefit)

- ~$3 goes to Yuba County for OES

- ~$10 goes to Yuba County to maintain sound walls

- ~$25 goes to admin and contingency.

- ~$105 to $~120 (depending on the zone of benefit) goes to Linda Fire to provide fire/EMS services

- ~$35 to ~$50 (depending on the zone of benefit) goes to RD784 to maintain drainage

- ~$165 to ~$185 (depending on the zone of benefit) goes to OPUD to maintain parks

*Linda Fire, RD784, and OPUD are independent local government agencies governed by an elected board of directors. If you have questions or concerns about how they are spending your CSA 66 tax dollars, please reach out to them directly.

TRLIA CFD 2006-1 & 2006-2

This assessment ranges from $0 to about $2000, depending on location, and goes to the Three Rivers Levee Improvement Authority (TRLIA) for paying back builder bonds that were sold to help finance the local share of $500+ million of levee upgrade work done to protect Plumas Lake and other areas of south Yuba County. You can find everything you ever wanted to know about TRLIA CFD 2006-1 & 2006-2 here, and for any questions, please get in touch with TRLIA. In 2021, TRLIA, Yuba Water Agency, and Yuba County completed an effort to reduce this special tax for homeowners. The reduction took effect for some taxpayers on their 2021 tax bill, but others will see relief over the next few years. When the reduction occurs depends on how “built-out” a neighborhood is and how quickly the rest of it develops. You can watch the video of this community meeting for details about how the reduction is achieved and the impact on specific neighborhoods.

RD784 (REC DIST 784) Assessment

The RD784 assessment ranges from ~$200 to ~$560 for single-family residential properties, depending on the size of the lot and home, and goes to RD784, which maintains over 30 miles of levees that protect Plumas Lake and other areas of south Yuba County. In addition, RD784 operates and maintains an internal drainage system that includes 60 miles of canals and drainage ditches, 10 pump stations, and more than 55 acres of detention basins. This assessment funds the operation and maintenance activities for both the levees and the internal drainage system. More information on the RD 784 O&M Assessment can be found here. For questions, reach out to RD784. (Note: In July 2019 property owners approved the consolidation of the previous TRLIA and RD784 assessments for maintenance and operations)

OPUD CFD 2002-1 Assessment

This assessment goes to OPUD and is used to pay back bonds to create water/sewer infrastructure to serve Plumas Lake. You can find everything you ever wanted to know about OPUD CFD 2002-1 here, and for any questions, please get in touch with OPUD. (Note: Before 2020, this assessment was $600 annually but was lowered to less than $300 after OPUD refinanced the bonds. Since then, OPUD continues to lower it annually as more people move to Plumas Lake and there are more houses to spread the debt service across). In 2024, this assessment is $211

OPUD CFD 2005-2 Park Assessment

This assessment goes to OPUD and is either $0, $85, $115, or $177, depending on location, to help maintain Plumas Lake Parks. You can find everything you ever wanted to know about OPUD CFD 2005-2 here, and if you have any questions, please contact OPUD.

Plumas Lake Elementary CFD Assessment

This assessment is $320 or $400 and goes to Plumas Lake Elementary School District (PLESD) to pay some of the construction costs for Rio Del Oro, Cobblestone, and Riverside school campuses. PLESD is a K-8 district serving Plumas Lake areas south of Algodon Rd. Any future school site construction will require additional voter-approved school bonds. Questions about this assessment should be directed to PLESD. (It should also be noted that residents who live north of Algodon Rd are in the Marysville Joint Unified School District and will have school bonds for that district on their tax bill instead)

CSA 70 Assessment

This assessment is ~$200 and is designed to provide supplemental funding for Yuba County law enforcement (sheriff, probation, district attorney). It’s paid by new developments County-wide, and some residents in Plumas Lake also pay it, primarily in homes sold after 2020.

Bold River Oaks South IA Assessment

This assessment is a mello-roos assessment paid (only) by residents in the River Oaks South neighborhood (the three developments south of Lennar in east Plumas Lake). It covers bonds sold to pay infrastructure costs for those subdivisions, and in 2023, it ranged from $1340-$1510 depending on the builder. It should be noted that residents in River Oaks South do not pay the PLESD CFD, TRLIA CFD, or OPUD CFD 2002-1 assessments.

Wheatland Area Special Assessments

Homeowners who live in the Wheatland Area (both within the city limits and outside the city), may have the following items on their tax bill, in addition to the WUHSD GO BOND 2016 and YCCD GO BOND school bonds described under the School Bonds section.

Rec Dist 2103 Levee and Facilities Asmt Dist

This assessment is paid to Reclamation District 2103 to help maintain levees that protect the Wheatland area. It appears to be around $75 to $150.

Wheatland Fire Authority

This assessment is paid to the Wheatland Fire Authority to help cover the cost of fire protection services to the area served by the Wheatland Fire Authority. It appears to be around $75-$100.

WHTLD-PREMIER GROVE LANDSCP & LIGHTG DIST # 25-02

This assessment appears to be paid by some homeowners in the Wheatland Park and Wheatland Ranch subdivisions, ranging from around $100 to $300. Landscape and Lighting Districts can be used to pay for streetlights, parks, and landscaping. You can call (800) 273-5167 for more info about this specific tax or reach out to the City of Wheatland.

SCIP 21-03 Caliterra Ranch Village I

This assessment is paid by homeowners in the Caliterra subdivisions and is around $2100. It’s likely mello roos to pay for the infrastructure needed for the new subdivision. You can call (800) 969-4382 for more info about this specific tax or reach out to the City of Wheatland.

School Bonds

WUHSD GO BOND 2012 & 2016

If you live in the Wheatland Union High School District, you will have these two assessments on your property tax bill and the amount will vary based on assessed value. The assessment is about 0.00016683 (combined for both) of assessed value so for a property assessed at $500k, it will be around $85. This assessment is a school bond approved by voters in 2012 and goes to Wheatland Union High School District to enhance/update facilities at Wheatland Union High School in Wheatland. For more info on the WUHSD bond, click here, and questions about this assessment should be directed to WUHSD.

WUHSD SFID No 1 Plumas Lake

If you live in the Plumas Lake portion of the Wheatland Union High School District, you will have this assessment on your property tax bill and the amount will vary based on assessed value. The assessment is about 0.00020229 of assessed value so for a property assessed at $500k, it will be around $100. This assessment is a school bond approved by voters in 2022 and goes to Wheatland Union High School District to begin the process of building a high school in Plumas Lake. Any future high school site construction will require additional voter-approved school bonds. For more info on the WUHSD bond, click here, and questions about this assessment should be directed to WUHSD.

MJUSD Election 2006 (H) & 2008 (P)

If you live in Marysville Joint Unified School District (rather than in Wheatland or Plumas Lake school districts), you likely have two MJUSD bond items on your property tax bill and the amount charged will vary based on assessed value. Combined, the assessment is about 0.00085079 of assessed value so for a property assessed at $500k, it will be around $425. These assessments go to MJUSD and questions about this assessment should be directed to MJUSD, and you can find information about some of the bonds here.

YCCD Election 2006 & 2016

You likely have two Yuba College bond items on your property tax bill and the amount charged will vary based on assessed value. Combined, the assessment is about 0.000315 of assessed value so for a property assessed at $500k, it will be around $160. These assessments go to the Yuba Community College District and are school bonds approved by voters to enhance/update facilities at Yuba Community College campuses. Questions about this assessment should be directed to the Yuba Community College District, and you can find information about some of the bonds here.

Property Tax Increases

Your property tax bill can increase for several reasons, including an increase in assessed value, inflationary increases to special assessments, and new assessments added by voters.

Increase in Assessed Value

Per Prop 13, the assessed value of your home can only go up by 2% per year. Your base 1% property tax is based on this assessed value. Some special assessments on your tax bill, usually school bonds, are also based on the assessed value. If your house is assessed at $500k, you will pay $5000 in base property tax. If the next year, the assessed value increases 2% to $510k, you will owe $5100 in base property tax. Similarly, if you have a school bond with a factor of 0.00020229 and your house is worth $500k, the bond assessment will be $101. If the assessed value increases to $510k the following year, the bond item will increase to $103.

Inflationary Increases

While some special assessments are fixed and do not change on an annual basis, others increase annually to keep pace with inflation. Whether a special assessment increases annually or is fixed, and by what index/percentage it increases, is set when the special assessment is created. It’s common for special assessments that fund ongoing services to have an annual increase to keep up with increasing costs.

Assessments Added by Voters

In elections, voters may choose to pass bonds to fund specific infrastructure or establish new assessments to fund additional or enhanced services. Voters may also choose to increase an existing assessment to provide additional funding to an existing service.

Sales Tax

Summary: Yuba County receives 1% of the baseline 7.25% sales tax as discretionary revenue. In FY 23/24, that’s anticipated to be about $5.3 million. In 2018, voters approved increasing the sales tax rate in unincorporated Yuba County to 8.25% (Measure K). This additional 1% is expected to generate $6 million in FY 23/24 and must be spent on public safety and essential services.

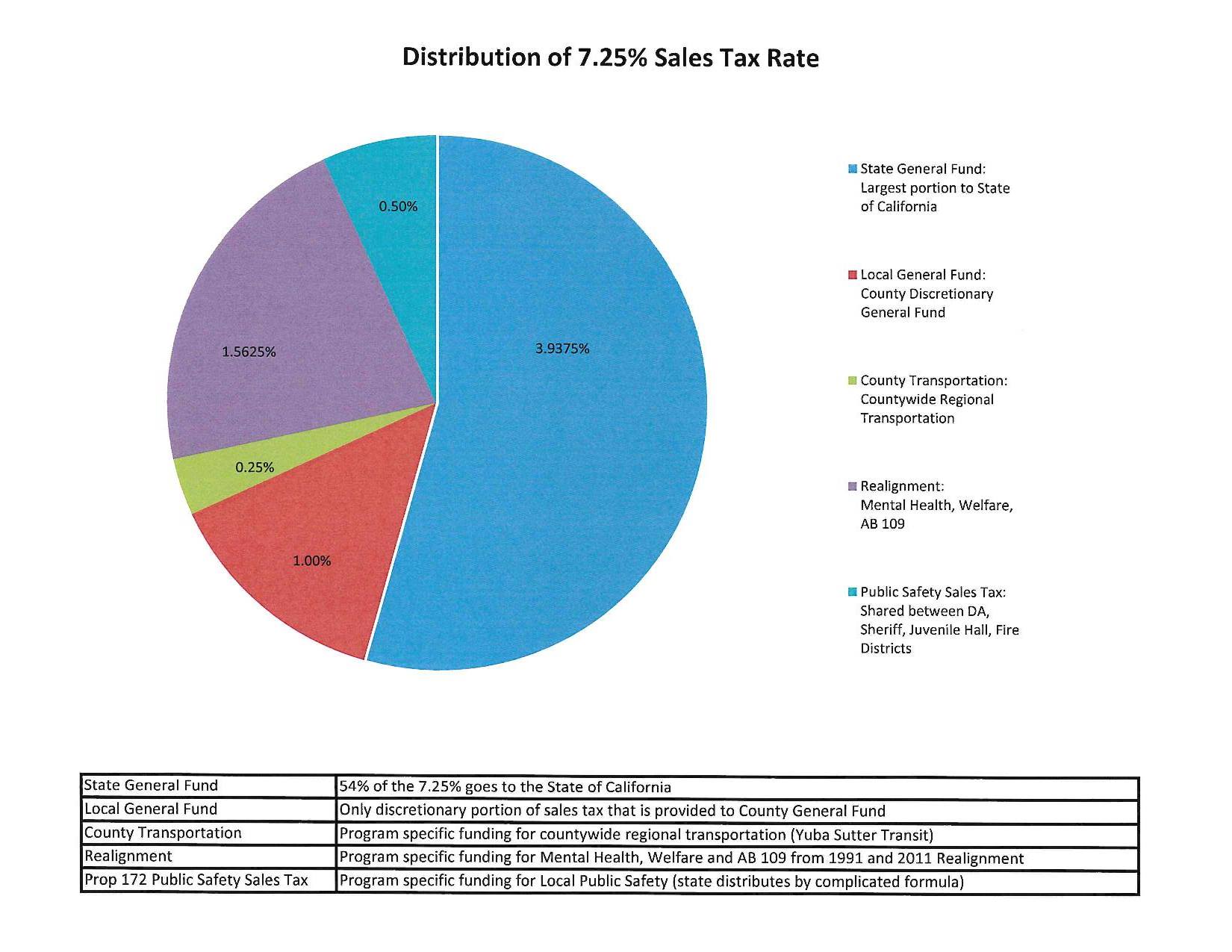

Details: The State sets the base sales tax rate at 7.25%, and below is a graph that shows the breakdown of that 7.25%. Out of the 7.25% collected, 1% comes to the County as discretionary revenue, which the Board of Supervisors (BOS) allocates. If you purchase a taxable item for $100, you will pay $7.25 in base sales tax, and the County will get $1. In the FY 23/24 budget, over 73% of the 1% sales tax received by the County was allocated to public protection departments, with 68% going to the three public safety departments [Sheriff (50%), Probation (13%), and District Attorney (5%)]. For a detailed description of how discretionary revenue (i.e., property and sales tax) is spent, you can view the FY23/24 budget. Pay close attention to the revenue line in each department’s budget summary labeled “Net County Cost.” These are the discretionary funds that go to that department.

Note: In 2018, voters approved raising the sales tax to 8.25% for ten years in unincorporated areas of the County. This additional 1% is expected to generate over $6 million in FY 23/24 and must be spent on public safety and essential services as indicated in the measure. As a general tax, Measure K revenue is discretionary and will be allocated by the Board of Supervisors as part of the annual budget process. In the FY 23/24 budget, $10.3M in (one-time + annual) Measure K revenue was allocated to various public safety and essential services departments within the County. You can find a breakdown of the allocation in the FY 23/24 Budget Highlights presentation. At the end of each fiscal year, the Measure K Citizens’ Oversight Committee publishes a report on how Measure K’s revenue was spent for the preceding year. You can find those reports here.

One comment

Comments are closed.